currency board definition

Here the country retains its own national currency but agrees to fix the value of that currency to the value of another countrys currency. A currency board is a monetary institution that only issues notes and coins.

A method of controlling the value of a currency by rigidly fixing the currencys value to a more widely used and dominant currency often the British pound or the US.

:max_bytes(150000):strip_icc()/dotdash_final_Constant_Currencies_Dec_2020-01-962ae57604464a59bd167a644f759ab7.jpg)

. A currency board is a second tier solution where the exchange rate of the currency is fixed to that of another country or a basket of currencies. A government organization in some countries that controls the value of its countrys currency often by setting a fixed exchange rate with the currency of another country. Entity charged with maintaining the value of a local currency with respect to some other specified currency.

An Updated Bibliography of Scholarly Writings 4 Steve H. The economist also called for the dollarization or the formation of a currency board for lasting stability. Currency Board - Currency Board Currency board definition A currency board is a central issuer of notes and coins for a given countrys currency.

Local banks increase the number of Hong Kong dollars only when they receive additional US. 21 Basic Features of a Currency Board 211 Definition of a Currency Board A currency board CB is a very simple strictly rule-bound institution for supplying an economy with a domestic currency. A currency board the so-called monetary office is set up to create the stability of a strong currency in inflation-prone and mostly poorer countries.

A currency board maintains absolute unlimited convertibility between its notes and coins and the currency against which they are pegged the anchor currency at a fixed rate of exchange with no restrictions on current-account or capital-account transactions. See also monetary policy and monetary system. A currency boards operations are passive and automatic.

The local currency can be exchanged only for the dominant currency at the fixed exchange rates. The currency board simply issues notes and coins and offers the service of converting local currency into the anchor currency at a fixed rate of exchange. Tiwari Rajnish 2003.

Therefore in the currency board system there can be no fiduciary issuing of money. A currency board is an exchange rate regime based on the full convertibility of a local currency into a reserve one by a fixed exchange rate and 100 percent coverage of the monetary supply backed up with foreign currency reserves. An exchange rate that is fixed to an anchor currency automatic convertibility that is the right to exchange domestic currency at this fixed rate whenever desired and a long-term commitment to the system which is often set out directly in the central bank law.

Le currency board en français caisse démission est un r égime monétaire dans lequel la parité de la monnaie nationale est strictement fixe par rapport à une devise étrangère souvent le dollar et lémission de monnaie strictement limitée par le montant des réserves de change dans la devise en question. In the past currency boards have usually been operating in place of a central bank although more recent. Two countries that use currency boards are Hong Kong and Panama.

The currency board also takes decisions about the valuation of a nations currency in a regime of the fixed foreign exchange rate of a currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exchange rate target. A currency board system is an exchange rate regime in which the monetary authority explicitly commits to exchanging the domestic currency with specified foreign currency for a fixed exchange rate.

Post-Crisis Exchange Rate Regimes in Southeast Asia. A Handbook 1994 revised edition 2015. A currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency.

PDF On Currency Boards. A currency board is a countrys monetary authority in India we do not have currency board RBI issues currency notes which is basically entrusted with the responsibility of issuing currency notes and coins. An Empirical Survey of De-Facto Policies Seminar Paper University of Hamburg.

The sole function of a currency board is to exchange the domestic currency. This means that the Central bank will not be able to extend credit. For example Argentina and Hong Kong had the US dollar as their anchor currency and Estonia Bosnia and Bulgaria had the euro.

Other articles where currency board is discussed. The next step along the spectrum in which countries retain at least symbolic if not effective monetary sovereignty is a currency board. Gold could yet make a comeback as a reserve currency.

A currency board combines three elements. For the purposes of this Law means an operational rule for issuing domestic currency whereby domestic currency is issued only against purchases of convertible foreign exchange with full backing by net foreign exchange reserves. What is a currency board.

Plus simplement l a banque central e perd son pouvoir propre démission. In such a case there is no central bank and the exchange rate is fixed. After Bretton Woods19th-century system known as a currency board.

Hanke and Kurt Schuler Currency Boards for Developing Countries. Currency board is a monetary regime in which the domestic currency is backed 100 by a foreign currency say dollars and in which the note-issuing authority whether the central bank or the government establishes a fixed exchange rate to this foreign currency and stands ready to exchange domestic currency at this rate whenever the public requests it. Dollars and they reduce the stock of Hong Kong dollars when US.

Characteristics Three main characteristics distinguish this system from other exchange rates. Economist calls for Venezuelas central bank to.

:max_bytes(150000):strip_icc()/GettyImages-1076728392-736a815311f4493aba2a3f1d1a4697e3.jpg)

Currency Depreciation Definition

/world-currency-rates-483658563-09879331c7a94e639775474879c61cf0.jpg)

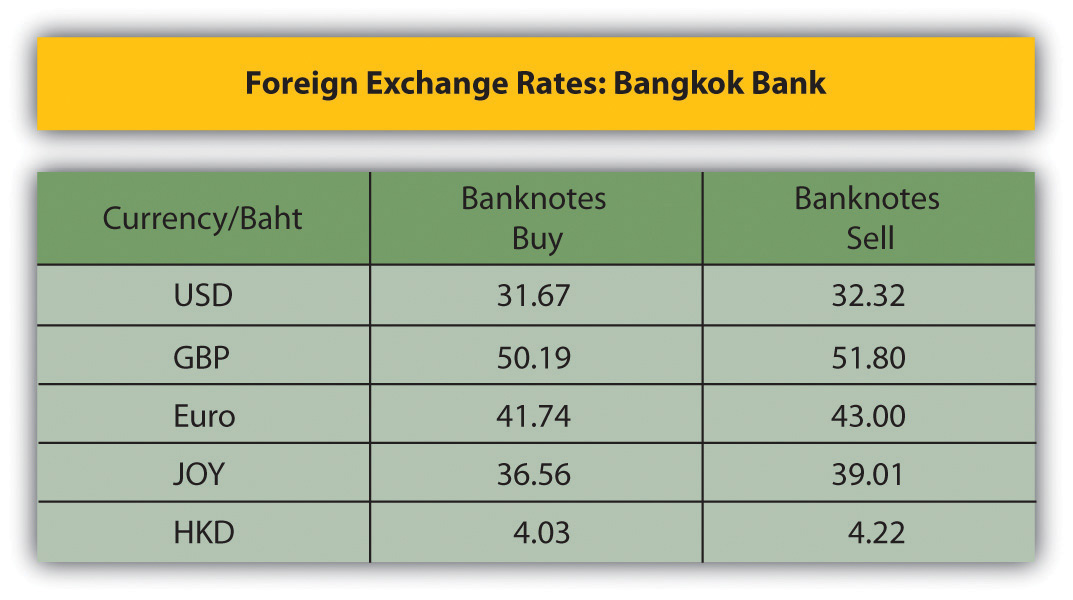

Buying And Selling In The Forex Market

/dotdash_final_Constant_Currencies_Dec_2020-01-962ae57604464a59bd167a644f759ab7.jpg)

Constant Currencies Definition

What Do We Mean By Currency And Foreign Exchange

:max_bytes(150000):strip_icc()/dotdash_final_Constant_Currencies_Dec_2020-01-962ae57604464a59bd167a644f759ab7.jpg)

Constant Currencies Definition

/GettyImages-1153657433_2600-573e917e27f9442eb87ac10f45ce43ea.jpg)

Foreign Exchange Forex Definition

:max_bytes(150000):strip_icc()/dkk_final-9e838f4cec8849f6add0f32ec234bb5b.png)

Dkk Danish Krone Definition And History

:max_bytes(150000):strip_icc()/forex3-5bfc2b9146e0fb00265beb54.jpg)

Fixed Exchange Rate Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Currency_Appreciation_Definition_Apr_2020-01-063bf4cdbc9e4f4d82fa4aa46738498d.jpg)

Currency Appreciation Definition

/GettyImages-1307216531-34795d28d620481dbc4987ec86eb9663.jpg)

Floating Rate Vs Fixed Rate What S The Difference

/Exchange_Money_Conversion_to_Foreign_Currency-6cb1cfd70952479681791b77ea685d55.jpg)

/147426339-5bfc2b9446e0fb005144dd09.jpg)

/forex8-5bfc2b9046e0fb0026016f83.jpg)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

/foreign-currency-804917648-e79b58313e114a94b198e49fd015098f.jpg)

/KMD15LAX-TBITcurrencyexchange_0367lg-5816986b5f9b581c0b63048f.jpg)

:max_bytes(150000):strip_icc()/shutterstock548307841vc-5bfc2b2d46e0fb0083c06c19.jpg)

/GettyImages-926129414-bb8c2b6bfd6e46729927cd917bb284e9.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1054017850-0c7ca7d8368c4ab681a3d9c0fd2892e8.jpg)

/dotdash_final_Constant_Currencies_Dec_2020-01-962ae57604464a59bd167a644f759ab7.jpg)

Comments

Post a Comment